Posted on: December 9, 2024

A bipartisan bill, the Employer Participation in Repayment Act, was introduced to incentivize employers to help address the student debt crisis. The bill allowed employers to offer their employees up to $5,250 tax-free each year to help pay off their student loans, and became law as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. The legislation received a five-year extension through January 1, 2026, under the Consolidated Appropriations Act, 2021.

Unless action is taken in 2025 to extend it, this tax-free assistance will no longer be available for employers or their employees who need it.

Why the Legislation Was Successful

The bipartisan bill received support because student loan debt has become a significant burden, with Americans owing $1.727 trillion on student loans. Student loan debt affects these borrowers in significant ways like delaying major purchases such as buying a home or car—or saving for retirement. These impacts have a ripple effect on the U.S. economy. Concern about the impact of student loan debt on borrowers and the economy united various stakeholders to take positive action.

How Student Loan Repayment Impacts Employees

What sort of impact can an employer make when making contributions to an employee’s student loan debt?

Let’s take a look at how it might work.

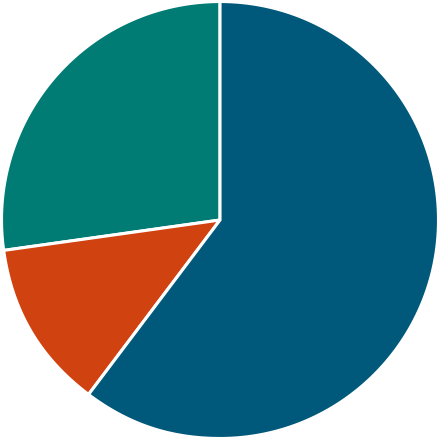

Impact of a $100 monthly employee contribution to a typical bachelor’s degree balance

WITH employer retirement plan you’d pay $22,150

Principal contributions $18,300

Employer contributions $8,200

Interest contributions $3,850

WITHOUT employer retirement plan you’d pay $32,196

Principal contributions $26,500

Interest contributions $5,696

Pay off debt 3 years, 1 month earlier and save $10,046 with a $100 monthly employer contribution

Assumptions: $26,500 loan balance, 4% rate, and 10-year term

Not only can employees shave time off their student loan payments, they can also get a jumpstart on retirement, depending on how assistance is set up.

How Employers Have Responded

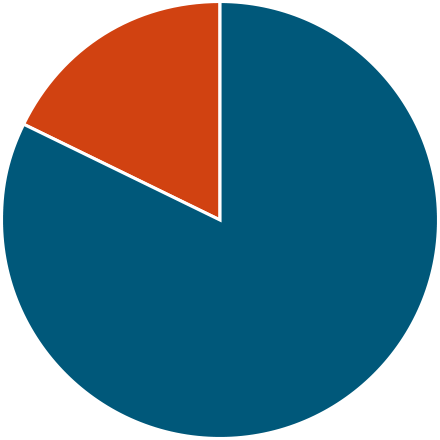

Despite the impact this can have for their employees—and the competitive edge the benefit can give them in a challenging job market—it’s been difficult to gauge how many employers have actually added the benefit.

While human resources software company Paycor showed 34% of employers offering student loan benefits in October 2023—up from 17% in 2021—the Society of Human Resources Management’s 2023 employer benefits survey found only 8% of employers offered a student loan repayment benefit.

It’s possible some employers aren’t aware of the opportunity, while others haven’t invested time or money into setting up and paying out on the program. It is conceivable others may be getting pushback from human resources or employee groups that contend it’s unfair to offer a benefit that isn’t available to all employees. It’s interesting to note that there are creative ways to design a program that offers benefits for both those with and without student loan debt.

Some benefits administrators like BenefitEd offer customizable products. These allow employers flexibility to offer payments to help employees who don’t qualify for a student loan repayment benefit. For example, with BenefitEd’s Employer Match, employers can choose to offer employees the option of receiving payments toward a 529 college savings account for help with future education costs or payments toward student loans.

Why Tax-Free Student Loan Repayment for Employers?

With most federal student loan borrowers returning to repayment in October 2023 after a three-year pause, student loan help from employers is still very much in demand by the employees who need it. In fact, 88% of employees say they would increase their commitment to their employer if offered student loan repayment assistance.

BenefitEd’s Employer Match product helped solve recruitment and retention issues for a client at Summit Community Care. They relied on college-educated employees, largely with social science degrees. In addition to gaining a recruitment edge, they also found productivity and employee morale were increased because of offering a flexible education benefit that appealed to more than one employee group.

Taking advantage of the tax-free student loan repayment benefit to find and retain employees—and meet the needs of your workforce—is still on the table in 2025. With relatively few companies offering it, those organizations that do stand out as having an even greater edge.

How BenefitEd Can Help With Student Loan Repayment

At BenefitEd, our expert team works with you to customize a flexible program designed to meet the needs of your employees, whether it’s using Employer-Assisted Student Loan Repayment or Employer Match.

If helping to pay your employees’ student loan debt isn’t in your organization’s budget, consider implementing an optional provision of SECURE Act 2.0 that allows you to recognize student loan payments as qualifying contributions to a retirement plan for matching purposes. This may allow employees who delay saving for retirement due to student loan payments to begin saving for retirement earlier. Making this simple change can have a significant impact on your employees’ financial future (and boost participation in your retirement plan, too).

BenefitEd can help with setting up and administering SECURE Act 2.0 matching payments.

Trust BenefitEd With All Your Education Benefits

Our experts can help your employees who struggle with student loans and those saving for future education costs. But we also offer tuition benefits for all your employees who wish to gain additional education to take their career to the next level. Contact our team to learn more about how we can help you support all of your employees and address your recruitment and retention challenges today.