Posted on: April 24, 2023

With the return to student loan repayment ahead, having a student loan repayment benefit can give you a competitive edge in today’s job market. It’s also imperative for today’s companies to employ a diverse workforce. While there are many different variables to consider when recruiting diverse talent, research shows that companies utilizing student loan benefits have a leg up on closing the diversity gap and helping underrepresented workers build successful careers.

A Harvard Business Review article shared that PricewaterhouseCoopers (PwC) leadership wanted to introduce a student loan paydown benefit in 2016. With 9,000 entry-level hires in the U.S. annually, student debt impacts a large number of PwC’s employees.1 Five years later, they shared data regarding participation in their benefit. The results are consistent with data that shows student debt disproportionately impacts those from under-represented groups: 62% of eligible Black employees and 52% of eligible Latinx employees participate in the benefit, which is a greater percentage than eligible white (47%) or Asian (22%) employees.2

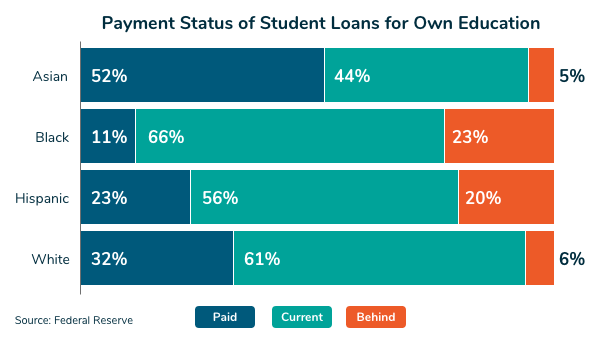

In fact, those statistics are not surprising when you look at the payment status of student loans among different groups, based on Federal Reserve data3:

The demographic groups that appear to struggle most with staying current on student loan payments, according to Federal Reserve data, were more likely to participate in PwC’s student loan repayment benefit.

This disparity among groups in repayment experience creates an opportunity for employers to help underrepresented graduates entering the workforce pay down their student loan debt. Offering student loan repayment assistance as part of an employee benefits package is a great way to alleviate this situation and boost diversity.

Employers are trying all different types of diversity initiatives, changing company culture, and broadening recruitment parameters. These companies should also be considering more robust debt relief benefits, as it would help an entire generation of new employees who are struggling with loan debt, especially underrepresented graduates. Offering a meaningful benefit that improves quality of life and reduces financial stress is a powerful way to gain a recruiting edge and increase diversity.

One employer that discovered the real-life impact of offering a student loan repayment benefit is Summit Community Care. They struggled to recruit qualified graduates with a social science degree. Adding a benefit that offered employer assistance with student loan debt gave them a competitive recruiting edge, but it also helped them gain loyalty among current employees.

In 2021, only 17% of employers offered repayment assistance, but 31% of companies were planning to provide it in the future.4 The time is now to gain a competitive advantage – and assist employees who will be returning to repayment with federal student loans in the coming months.

To learn more about Employer-Assisted Student Loan Repayment, contact BenefitEd.

1 https://hbr.org/2021/03/companies-can-and-should-help-employees-pay-student-loans

2 https://www.pwc.com/us/en/about-us/diversity/assets/diversity-inclusion-transparency-report.pdf